In late 2013 the S.C. Department of Health and Environmental Control issued policy guidance on the installation of sediment basins. The guidance document is designed to be an aid in designing and constructing sediment basins. Many engineers use the guidance methods in their work for our developer members.

However, as is sometimes the case with generalized guidance, the design guideline worked well in some parts of the state, where soils drain rapidly, but note in the Upstate where the most common soil type is clay.

Your Home Builders Association met with Greenville County and City of Greenville engineering departments, and then with DHEC officials to propose alternatives that are more suitable to the Upstate. Your Home Builders Association, in consultation with Greenville County Land Development Services, proposed additional language for DHEC's policy guidance document. After some editing, the guidance document for Sediment Basins now includes the following langage:

Guidance Disclaimer

This is a guidance document and may not be feasible in all situations. Alternative means and methods for sediment basin design and construction also may be employed.

All means and methods must comply with the DHEC South Carolina NPDES General Permit for Stormwater Discharges from Construction Activities (Permit). Approved means and methods include those published and approved by an MS4 in compliance with the Permit.

In addition, a licensed Professional Engineer may design a sediment basin that, when constructed, accommodates the anticipated sediment loading from the land-disturbing activity and meets a removal efficiency of 80% suspended solids or 0.5 ML/L peak settable solids concentration, whichever is less, while remaining in compliance with the Permit.

Greenville County Land Development Services has published alternative guidance for Sediment Basins, which is available by clicking here. A copy of DHEC's Sediment Basin Guidance document with the disclaimer above can be viewed by clicking here.

This success is an example of the advocacy efforts that your Home Builders Association works on every day on behalf of our members and the Home Building industry. Your Home Builders Association's advocacy efforts save our members tens of thousands of dollars in unnecessary development and building expenses each year.

Thank you for being a member of your Home Builders Association and supporting these advocacy efforts on your behalf.

Saturday, May 10, 2014

U.S. Post Office mandates centralized mailboxes in new subdivisions

Effective April 5, 2012, the United States Postal Service began mandating mail delivery in new subdivisions to be made to centralized mailbox locations, called Cluster Box Units (CBU), instead of curbside delivery.

As a result, many local governments are updating their development standards to address the postal service's new policy. Greenville County has included the new policy in the pending update to the Land Development Regulations. The ordinance will simply require that a CBU or CBUs be installed according to the postal services regulations and that the location of the CBUs be reflected on the preliminary plat for the subdivision. Greenville County will require an affidavit from the postal service that your subdivision plan complies with their policy before your preliminary subdivision plat will be approved.

Your Home Builders Association worked with other HBAs in South Carolina to try to influence the outcome of this new policy, but ultimately our efforts only resulted in a delay in implementation. According to the postal service, all new subdivisions must comply with the policy and those that do not will not be served by the postal service.

There is a variance procedure outlined in the postal service's policy manual for extenuating situations, like handicap accessibility issues. In addition, options for smaller subdivisions do include using a CBU that contains just four mailboxes, positioned near the four homes.

Your Home Builders Association cautions developers not to rely on the local jurisdiction approving your subdivision to guide you on this new requirement. Not all jurisdictions have included this requirement in their ordinances, and yet the postal service will enforce the requirement none-the-less.

To download and review the "Builder and Developer Information Packet for the use and installation of Cluster Box Units," click here.

For more information about this new policy, contact the U.S. Postal Service's South Carolina Growth Management Department at 803-926-6280.

As a result, many local governments are updating their development standards to address the postal service's new policy. Greenville County has included the new policy in the pending update to the Land Development Regulations. The ordinance will simply require that a CBU or CBUs be installed according to the postal services regulations and that the location of the CBUs be reflected on the preliminary plat for the subdivision. Greenville County will require an affidavit from the postal service that your subdivision plan complies with their policy before your preliminary subdivision plat will be approved.

Your Home Builders Association worked with other HBAs in South Carolina to try to influence the outcome of this new policy, but ultimately our efforts only resulted in a delay in implementation. According to the postal service, all new subdivisions must comply with the policy and those that do not will not be served by the postal service.

There is a variance procedure outlined in the postal service's policy manual for extenuating situations, like handicap accessibility issues. In addition, options for smaller subdivisions do include using a CBU that contains just four mailboxes, positioned near the four homes.

Your Home Builders Association cautions developers not to rely on the local jurisdiction approving your subdivision to guide you on this new requirement. Not all jurisdictions have included this requirement in their ordinances, and yet the postal service will enforce the requirement none-the-less.

To download and review the "Builder and Developer Information Packet for the use and installation of Cluster Box Units," click here.

For more information about this new policy, contact the U.S. Postal Service's South Carolina Growth Management Department at 803-926-6280.

Labels:

land development,

U.S. Postal Service

Thursday, May 8, 2014

Economic Index Shows Metro Markets Continuing on Path to Normalcy

Greenville Holds Steady at 88 Percent of Normal, Spartanburg is at 85 percent

Of the 351 metro markets measured, 300 have seen year-over-year economic gains, according to the National Association of Home Builders/First American Leading Markets Index (LMI), released today. The index shows that 59 metros have fully returned to or even exceeded their last normal levels of economic and housing activity.

The nationwide economic score rose slightly to .88 from a revised April reading of .87. This means that based on current permit, price and employment data, the nationwide average is running at 88 percent of normal economic and housing activity. The index showed an overall reading of .82 a year ago.

In Greenville, permits are at 54 percent of normal, jobs are at 93 percent of normal, and housing prices are at 116 percent of normal. "This data indicates that Greenville, like many markets in the country, has an insufficient supply of new housing to meet demand," Mike Freeman, GMB, President of the Home Builders Association of Greenville, said. Greenville was at its lowest, in relation to normal, in the fourth quarter of 2011 at 78 percent. Greenville peaked at 111 percent of normal in the third and fourth quarter of 2006.

Spartanburg, which is a separate market in the study, is at 85 percent of normal. Permits in Spartanburg are at 54 percent, jobs are at 96 percent, and housing prices are at 105 percent. Spartanburg peaked higher than Greenville, at 115 percent of normal, also in 2006. Spartanburg also dropped further than Greenville, to 73 percent of normal, where it remained for most of 2011. Spartanburg has been a "most improved" market, rising rapidly over the last year.

“We have always said this recovery would be a slow but steady one, and I think this index continues to prove this,” said NAHB Chief Economist David Crowe. “The year started a bit slower than anyone could have anticipated but we still expect housing to play a greater role in aiding the overall economic recovery this year. The job market continues to mend and that should spur a steady release of pent up demand among home buyers.”

Keeping its top position of major metros on the LMI was Baton Rouge, La. with a score of 1.41 – or 41 percent better than its last normal market level. Other major metros whose LMI scores indicate that their market activity now exceeds previous norms include Honolulu, Oklahoma City, Austin and Houston, Texas, as well as Los Angeles and San Jose, Calif. and Harrisburg, Pa.

“Our builder members tell us they are starting to see more optimism in the field,” said NAHB Chairman Kevin Kelly, a home builder and developer from Wilmington, Del. “Mortgage rates are low, home prices are affordable and with the harsh winter behind us our latest surveys show builders are feeling more bullish about future sales conditions.”

“We keep waiting for the economy to get into a higher gear,” said Kurt Pfotenhauer, vice chairman of First American Title Insurance Co., which co-sponsors the LMI report. “This report, along with other recent economic news, may mean we are finally there.” Smaller metros experiencing an energy boom continue to lead the recovery. Odessa and Midland, Texas boast LMI scores of 2.0 or better, with their markets now at double their strength prior to the recession. Also at the top of the list of smaller metros are Bismarck, N.D.; Casper, Wyo.; and Grand Forks, N.D., respectively.

The LMI shifts the focus from identifying markets that have recently begun to recover, which was the aim of a previous gauge known as the Improving Markets Index, to identifying those areas that are now approaching and exceeding their previous normal levels of economic and housing activity. More than 350 metro areas are scored by taking their average permit, price and employment levels for the past 12 months and dividing each by their annual average over the last period of normal growth. For single-family permits and home prices, 2000-2003 is used as the last normal period, and for employment, 2007 is the base comparison. The three components are then averaged to provide an overall score for each market; a national score is calculated based on national measures of the three metrics. An index value above one indicates that a market has advanced beyond its previous normal level of economic activity.

Labels:

economics,

Leading Markets Index,

Mike Freeman,

NAHB

Tuesday, May 6, 2014

Smaller Banks Are the Largest Source of AD&C Lending

Data from the FDIC indicate that smaller financial institutions, typically community banks, are the most common sources of lending for home building acquisition, development and construction (AD&C) loans. This trend strengthened during years of the housing crisis.

The FDIC data are split into two sources: commercial banks and savings institutions. As of the final quarter of 2013, total 1-4 residential construction and development loans held by commercial banks summed to $38.9 billion. Such loans from savings institutions represented a smaller source: $4.8 billion.

With respect to commercial banks, the fourth quarter 2013 FDIC data reveal that 62% of home building AD&C lending was held by banks roughly matching the community bank standard of possessing less than $10 billion in total assets. This lending was decentralized as there are almost 5800 such institutions, although it is not possible to determine how many held residential AD&C loans. In contrast, there were 90 commercial banks with more than $10 billion in assets, holding a still significant $14.7 billion in home building AD&C loans.

Nonresidential AD&C lending, which includes some land development financing and commercial real estate, is more likely to be held by larger banks, as the chart above indicates. In fact, more than half (56%) of such loans were held by commercial banks with more than $10 billion in assets.

A larger share of residential AD&C was held by larger institutions prior to the recession. The chart above notes the change in market share from the end of 2007 to the end of 2013. While the share of nonresidential AD&C held by large banks increased over this six-year period, the market share of residential AD&C shifted to smaller banks. For example, at the end of 2007, 52% of home building AD&C was held by banks with more than $10 billion in assets, a swing of 14 percentage points of market share from 2007 to 2013.

The smaller savings institutions side of the market tells a similar story. At the end of 2013, 86% of home building AD&C loans held by savings institutions was controlled by institutions with less than $5 billion in assets. A noticeable difference is that both residential and nonresidential AD&C lending shifted, in terms of market share, toward smaller savings institutions from the end of 2007 to the end of 2013, as the following chart demonstrates.

Labels:

AD&C,

AD+C Lending,

community banks,

FDIC,

home building,

Home Loans,

small banks

NAHB- Eye on Housing: New Homes are Less Expensive to Maintain

New Homes are Less Expensive to Maintain

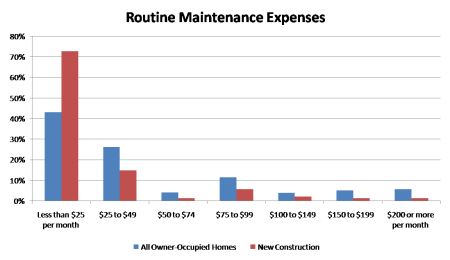

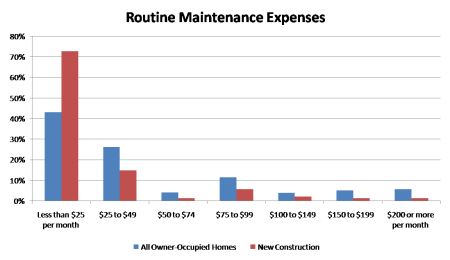

April is new homes month. And one of the virtues of a newly constructed home is the savings that come from reduced energy and maintenance expenses.

In a previous analysis, we used data from the 2009 American Housing Survey (AHS) to offer proof. The AHS classifies new construction as homes no more than four years old.

For routine maintenance expenses, 26% of all homeowners spent $100 or more a month on various upkeep costs. However, only 11% of owners of newly constructed homes spent this amount. In fact, 73% of new homeowners spent less than $25 a month on routine maintenance costs.

Similar findings are available for energy expenses. According to the 2011 AHS, on a median per square foot basis, homeowners spent 81 cents per square foot per year on electricity. Owners of new homes spent less: 68 cents per square foot per year. For homes with piped gas, homeowners spent on average 50 cents per square foot per year. Owners of new homes spent just 34 cents per square foot per year.

The 2011 data show similar results for various other utilities. For water bills, homeowners averaged 28 cents per square foot per year, while owners of new homes averaged 22 cents. For trash bills, the median for all homeowners was 15 cents per square foot per year, while for new construction the median was 13 cents per square foot per year.

These data highlight that a new home offers savings over the life of ownership due to reduced operating costs. And in fact, these reduced costs result in lower insurance bills as well. The median cost for all homeowners of property insurance is 39 cents per square foot, while it is only 31 cents per square foot for owners of new homes.

These reduced expenditures represent one of the many reasons that the current system of appraisals needs updating to reflect the flow of benefits that come from features in a new home.

Content provided by NAHB.

In a previous analysis, we used data from the 2009 American Housing Survey (AHS) to offer proof. The AHS classifies new construction as homes no more than four years old.

For routine maintenance expenses, 26% of all homeowners spent $100 or more a month on various upkeep costs. However, only 11% of owners of newly constructed homes spent this amount. In fact, 73% of new homeowners spent less than $25 a month on routine maintenance costs.

Similar findings are available for energy expenses. According to the 2011 AHS, on a median per square foot basis, homeowners spent 81 cents per square foot per year on electricity. Owners of new homes spent less: 68 cents per square foot per year. For homes with piped gas, homeowners spent on average 50 cents per square foot per year. Owners of new homes spent just 34 cents per square foot per year.

The 2011 data show similar results for various other utilities. For water bills, homeowners averaged 28 cents per square foot per year, while owners of new homes averaged 22 cents. For trash bills, the median for all homeowners was 15 cents per square foot per year, while for new construction the median was 13 cents per square foot per year.

These data highlight that a new home offers savings over the life of ownership due to reduced operating costs. And in fact, these reduced costs result in lower insurance bills as well. The median cost for all homeowners of property insurance is 39 cents per square foot, while it is only 31 cents per square foot for owners of new homes.

These reduced expenditures represent one of the many reasons that the current system of appraisals needs updating to reflect the flow of benefits that come from features in a new home.

Content provided by NAHB.

Monday, May 5, 2014

Board of Directors Supports Effort to Let Voters Decide on a Penny Sales Tax for Roads

UPDATE May 7, 2014:

County Council gave first reading to an ordinance to place a question on the ballot in November for voters to decide whether to increase the sales tax by one penny in Greenville County to pay for road projects. President Mike Freeman, GMB, and Government Affairs Chairman Coleman Shouse spoke in support of letting the voters decide.

The vote in Committee of the Whole was 8 to 3, with council members Cates, Dill, and Meadows opposed. County Council has one vacancy that will not be filled until the first council meeting in July.

A public hearing is planned for June 3. Two additional readings and votes are required for the ordinance to pass.

The Board of Directors of your Home Builders Association is supporting an effort to allow the voters of Greenville County to decide whether they would like to impose on themselves a special local option sales tax for road improvements and resurfacing, bridge repair and replacement, and pedestrian facilities improvements.

A task force of 20 citizens from around Greenville County, appointed by County Council and called the Greenville Citizen Roads Advisory Commission, studied the county's transportation infrastructure needs over the course of three months beginning in January. They presented their report to County Council in late March and recommended nearly $700 million in critical funding needs including $300 million for road resurfacing and $40 million for bridge repair and replacement. The commission held several public meetings throughout the county and received reports from every city, county staff, and the Department of Transportation. Their report

Based on the current funding stream, it could take decades to complete all of the projects that have been identified, and that assumes that no new needs arise, which is unlikely.

"The association will generally support a broad-based funding measure to fund critical infrastructure needs that are well-thought out and presented," Michael Dey, Executive Vice President of the Home Builders Association, said. "In this case, the commission thoroughly researched Greenville County's needs and developed a sound proposal of needed repairs and improvements," Dey said. "The Board of Directors is supporting giving the voters of Greenville County the opportunity to make the choice, which is the method provided for in state law. Of course there were lots of other suggestions for paying for our road needs, including and impact fee on construction, or a tax on the transfer of real property. A broad-based solution will best solve this problem," Dey said.

The first step is for County Council to agree to allow the voters to decide whether they would like to tax themselves. A poll conducted by the National Association of Realtors, released this week, found that 83 percent of 400 likely voters in Greenville County want to have the chance to vote in a referendum and decide whether they would like to tax themselves to pay for critical transportation needs. The process starts May 6, when County Council will consider on first reading a referendum to place the question on the ballot in November.

The one-cent sales tax, if approved, would last 8 years and is expected to raise about $680 million. Note: if voters approve the project list and tax, no governmental body can alter the list of projects funded by the special tax.

To read more on the proposed transportation improvements at GreenvilleCounty.org, click here.

County Council gave first reading to an ordinance to place a question on the ballot in November for voters to decide whether to increase the sales tax by one penny in Greenville County to pay for road projects. President Mike Freeman, GMB, and Government Affairs Chairman Coleman Shouse spoke in support of letting the voters decide.

The vote in Committee of the Whole was 8 to 3, with council members Cates, Dill, and Meadows opposed. County Council has one vacancy that will not be filled until the first council meeting in July.

A public hearing is planned for June 3. Two additional readings and votes are required for the ordinance to pass.

The Board of Directors of your Home Builders Association is supporting an effort to allow the voters of Greenville County to decide whether they would like to impose on themselves a special local option sales tax for road improvements and resurfacing, bridge repair and replacement, and pedestrian facilities improvements.

A task force of 20 citizens from around Greenville County, appointed by County Council and called the Greenville Citizen Roads Advisory Commission, studied the county's transportation infrastructure needs over the course of three months beginning in January. They presented their report to County Council in late March and recommended nearly $700 million in critical funding needs including $300 million for road resurfacing and $40 million for bridge repair and replacement. The commission held several public meetings throughout the county and received reports from every city, county staff, and the Department of Transportation. Their report

Based on the current funding stream, it could take decades to complete all of the projects that have been identified, and that assumes that no new needs arise, which is unlikely.

"The association will generally support a broad-based funding measure to fund critical infrastructure needs that are well-thought out and presented," Michael Dey, Executive Vice President of the Home Builders Association, said. "In this case, the commission thoroughly researched Greenville County's needs and developed a sound proposal of needed repairs and improvements," Dey said. "The Board of Directors is supporting giving the voters of Greenville County the opportunity to make the choice, which is the method provided for in state law. Of course there were lots of other suggestions for paying for our road needs, including and impact fee on construction, or a tax on the transfer of real property. A broad-based solution will best solve this problem," Dey said.

The first step is for County Council to agree to allow the voters to decide whether they would like to tax themselves. A poll conducted by the National Association of Realtors, released this week, found that 83 percent of 400 likely voters in Greenville County want to have the chance to vote in a referendum and decide whether they would like to tax themselves to pay for critical transportation needs. The process starts May 6, when County Council will consider on first reading a referendum to place the question on the ballot in November.

The one-cent sales tax, if approved, would last 8 years and is expected to raise about $680 million. Note: if voters approve the project list and tax, no governmental body can alter the list of projects funded by the special tax.

To read more on the proposed transportation improvements at GreenvilleCounty.org, click here.

Labels:

Greenville County,

Roads,

Sales Tax,

Transportation Planning

Subscribe to:

Comments (Atom)