Greenville County Recereation needs a lot of soil to cover this ground, and is willing give a donation receipt through Greater Greenville Parks Foundation to those who can help bring soil to Poe Mill. It is a convenient location to dump topsoil and mineral soil for those projects that need to haul dirt somewhere.

If you are interested please contact Ty Houck, the Director of Greenways, Natural and Historic Resources for the Greenville County Parks at (864) 676-2180 ext 141.

Thursday, May 12, 2016

Need a convenient location to dump soil? Help Greenville County Recreation and get a donation receipt!

Greenville County Recreation is working with the Greenville County Redevelopment Authority to turn Poe Mill into a park. Part of the site clean up requires Greenville County Recreation to cover all existing dirt surfaces with 3' of dirt.

Wednesday, May 11, 2016

2015 National Green Building Standard Available Now for Free

Green builders, remodelers, developers and verifiers have all heard the news: The ICC/ASHRAE 700-2015 National Green Building Standard™ has been approved by the American National Standards Institute.

But maybe you haven’t heard the equally great news: The standard can be downloaded as a PDF from the National Association of Home Builders BuilderBooks site. And it’s absolutely free.

If you aren’t familiar with how it works, the standard is a green building rating system that assigns points for green and sustainable building practices in the areas of water, resource and energy efficiency, indoor environmental quality, lot and site development and home owner education. To be certified, builders, residential developers and remodelers must meet certain thresholds across all categories to meet the Bronze, Silver, Gold, or ultra-green Emerald levels of certification.

What’s new in the 2015 edition? Improvements and more stringent rating levels in the energy efficiency section, changes that reflect new stormwater management practices, an expanded universal design section and more. You can get the details in this Home Innovation Research Labs press release. Home Innovation trains and accredits the verifiers that builders hire to certify their green projects.

Visit builderbooks.com/ngbs to download your free e-book.

But maybe you haven’t heard the equally great news: The standard can be downloaded as a PDF from the National Association of Home Builders BuilderBooks site. And it’s absolutely free.

If you aren’t familiar with how it works, the standard is a green building rating system that assigns points for green and sustainable building practices in the areas of water, resource and energy efficiency, indoor environmental quality, lot and site development and home owner education. To be certified, builders, residential developers and remodelers must meet certain thresholds across all categories to meet the Bronze, Silver, Gold, or ultra-green Emerald levels of certification.

What’s new in the 2015 edition? Improvements and more stringent rating levels in the energy efficiency section, changes that reflect new stormwater management practices, an expanded universal design section and more. You can get the details in this Home Innovation Research Labs press release. Home Innovation trains and accredits the verifiers that builders hire to certify their green projects.

Visit builderbooks.com/ngbs to download your free e-book.

Regulation: 24.3 Percent of the Average New Home Price

A new National Association of Home Builders study shows that, on average, regulations imposed by government at all levels account for 24.3 percent of the final price of a new single-family home built for sale. Three-fifths of this—14.6 percent of the final house price—is due to a higher price for a finished lot resulting from regulations imposed during the lot’s development. The other two-fifths—9.7 percent of the house price—is the result of costs incurred by the builder after purchasing the finished lot.

The National Association of Home Builders' previous 2011 estimates were fairly similar, showing that regulation on average accounted for a quarter of a home’s price. However, the price of new homes increased substantially in the interim. Applying percentages from the National Association of Home Builders' studies to Census data on new home prices produces an estimate that regulatory costs in an average home built for sale went from $65,224 to $84,671—a 29.8 percent increase during the roughly five-year span between the National Association of Home Builders' 2011 and 2016 estimates.

In comparison, during that time, disposable income per capita in the U.S. increased by 14.4 percent. In other words, the cost of regulation in the price of a new home is rising more than twice as fast as the average American’s ability to pay for it.

The above estimates are based largely on questions included in the survey for the March 2016 National Association of Home Builders'/Wells Fargo Housing Market Index, combined with long-run assumptions about average construction times, interest rates, profit margins, etc. The survey questionnaire and an appendix describing each additional assumption and the data on which it’s based can be found in the full study. The full study also contains substantial additional detail on the different types of regulatory costs and where and how they impact the development-construction process.

The above estimates are based largely on questions included in the survey for the March 2016 National Association of Home Builders'/Wells Fargo Housing Market Index, combined with long-run assumptions about average construction times, interest rates, profit margins, etc. The survey questionnaire and an appendix describing each additional assumption and the data on which it’s based can be found in the full study. The full study also contains substantial additional detail on the different types of regulatory costs and where and how they impact the development-construction process.

Remodeling Month Is In Full Swing

May is when the flowers are all blooming, the temperatures are rising, and a large number of home shoppers are interested in buying. But the springtime housing market isn’t just for buyers and sellers.

This is the time of year when a large number of home owners are highly motivated to cross off a few items from their home improvement to-do lists.

Last year, Americans spent an estimated $150 billion on owner-occupied remodeling projects. After a somewhat mild start to 2016, the remodeling industry is primed for continued growth as the year progresses – growth that’s sure to be amplified during the month of May when the National Association of Home Builders Remodelers celebrates National Home Remodeling Month.

Remodelers across the country are encouraged to further emphasize the benefits of home remodeling projects and the advantages of hiring a professional to get the job done right the first time.

Throughout the upcoming month, NAHBNow will feature several recent projects, techniques and strategies from NAHB members that have helped deliver more value to their clients and drive more traffic to their business, despite the increasing competition.

NAHB also makes it easy for remodelers to promote their industry with a toolkit of ready-to-use resources to engage consumers with trending remodeling topics such as:

A guide on how to get started promoting National Home Remodeling Month is available on nahb.org, along with tips to maximize consumer outreach.

This is the time of year when a large number of home owners are highly motivated to cross off a few items from their home improvement to-do lists.

Last year, Americans spent an estimated $150 billion on owner-occupied remodeling projects. After a somewhat mild start to 2016, the remodeling industry is primed for continued growth as the year progresses – growth that’s sure to be amplified during the month of May when the National Association of Home Builders Remodelers celebrates National Home Remodeling Month.

Remodelers across the country are encouraged to further emphasize the benefits of home remodeling projects and the advantages of hiring a professional to get the job done right the first time.

Throughout the upcoming month, NAHBNow will feature several recent projects, techniques and strategies from NAHB members that have helped deliver more value to their clients and drive more traffic to their business, despite the increasing competition.

NAHB also makes it easy for remodelers to promote their industry with a toolkit of ready-to-use resources to engage consumers with trending remodeling topics such as:

- Benefits of hiring a professional remodeler

- Facts about aging in place

- Basics of green remodeling

- Lists of top remodeling projects

- Suggestions on how to hire a remodeler

A guide on how to get started promoting National Home Remodeling Month is available on nahb.org, along with tips to maximize consumer outreach.

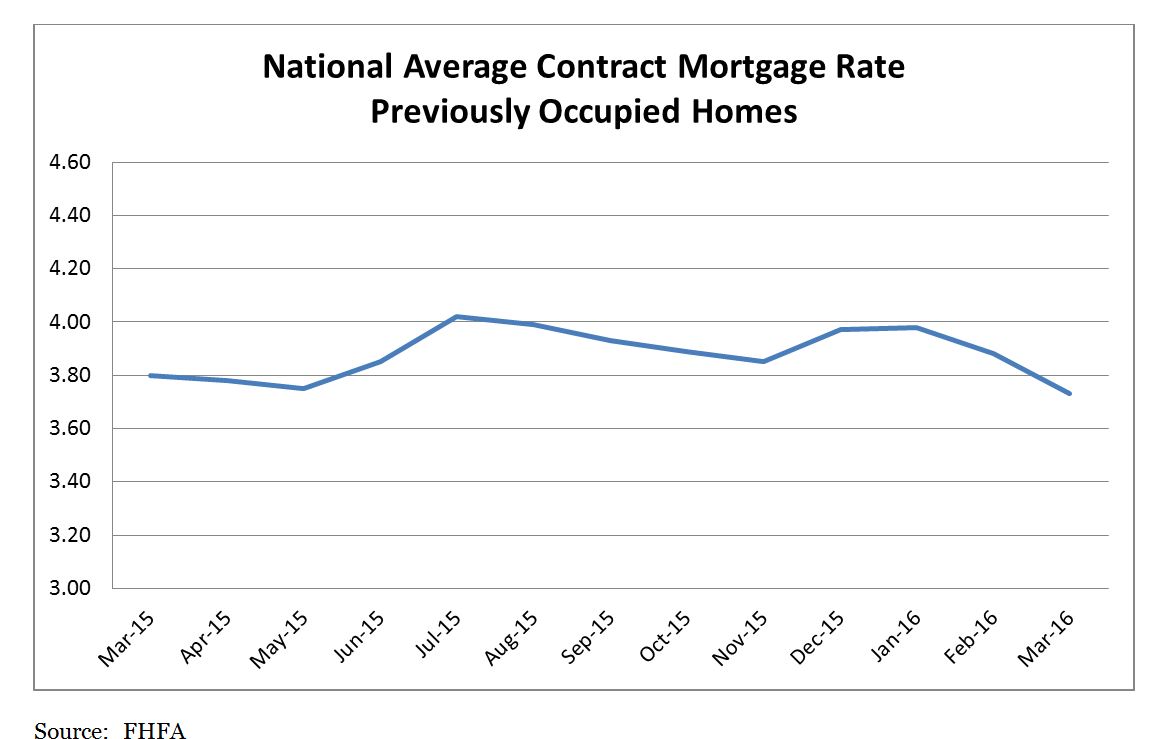

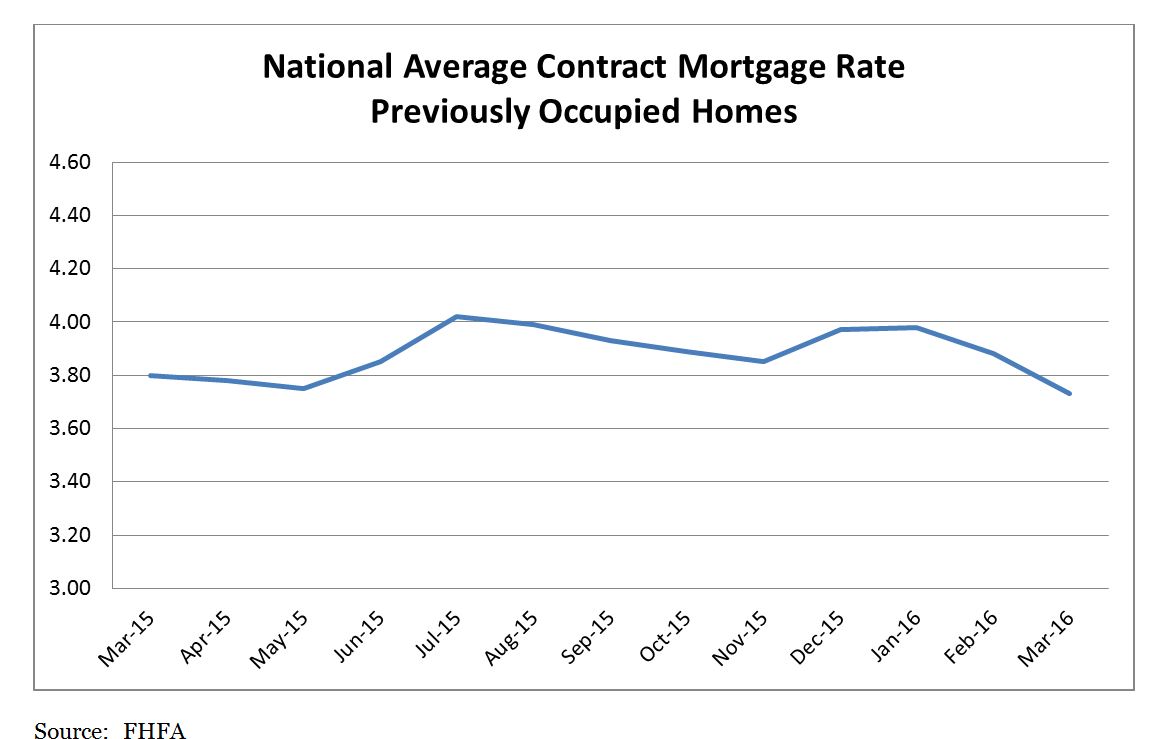

Federal Housing Finance Agency Index Shows Mortgage Interest Rates Decreased in March

From the Federal Housing Finance Agency:

Nationally, interest rates on conventional purchase-money mortgages decreased from February to March, according to several indices of new mortgage contracts.

The National Average Contract Mortgage Rate for the Purchase of Previously Occupied Homes by Combined Lenders Index was 3.73 percent for loans closed in late March, down 15 basis points from 3.88 percent in February.

The average interest rate on all mortgage loans was 3.76 percent, down 13 basis points from 3.89 in February.

The average interest rate on conventional, 30-year, fixed-rate mortgages of $417,000 or less was 3.95 percent, down 16 basis points from 4.11 in February.

The effective interest rate on all mortgage loans was 3.88 percent in March, down 15 basis points from 4.03 in February. The effective interest rate accounts for the addition of initial fees and charges over the life of the mortgage.

The average loan amount for all loans was $325,000 in March, up $8,300 from $316,700 in February.

Federal Housing Finance Agency will release April index values Thursday, May 26, 2016.

Technical note: The indices are based on a small monthly survey of mortgage lenders, which may not be representative. The sample is not a statistical sample but is rather a convenience sample. Survey respondents were asked to report terms and conditions of all conventional, single-family, fully amortized purchase-money loans closed during the last five working days of the month. Unless otherwise specified, the indices include 15-year mortgages and adjustable-rate mortgages. The indices do not include mortgages guaranteed or insured by either the Federal Housing Administration or the U.S. Department of Veterans Affairs. The indices also excluded refinancing loans and balloon loans. March 2016 values are based on 4,319 reported loans from 16 lenders, which include savings associations, mortgage companies, commercial banks, and mutual savings banks.

The National Average Contract Mortgage Rate for the Purchase of Previously Occupied Homes by Combined Lenders Index was 3.73 percent for loans closed in late March, down 15 basis points from 3.88 percent in February.

The average interest rate on all mortgage loans was 3.76 percent, down 13 basis points from 3.89 in February.

The average interest rate on conventional, 30-year, fixed-rate mortgages of $417,000 or less was 3.95 percent, down 16 basis points from 4.11 in February.

The effective interest rate on all mortgage loans was 3.88 percent in March, down 15 basis points from 4.03 in February. The effective interest rate accounts for the addition of initial fees and charges over the life of the mortgage.

The average loan amount for all loans was $325,000 in March, up $8,300 from $316,700 in February.

Federal Housing Finance Agency will release April index values Thursday, May 26, 2016.

Technical note: The indices are based on a small monthly survey of mortgage lenders, which may not be representative. The sample is not a statistical sample but is rather a convenience sample. Survey respondents were asked to report terms and conditions of all conventional, single-family, fully amortized purchase-money loans closed during the last five working days of the month. Unless otherwise specified, the indices include 15-year mortgages and adjustable-rate mortgages. The indices do not include mortgages guaranteed or insured by either the Federal Housing Administration or the U.S. Department of Veterans Affairs. The indices also excluded refinancing loans and balloon loans. March 2016 values are based on 4,319 reported loans from 16 lenders, which include savings associations, mortgage companies, commercial banks, and mutual savings banks.

Monday, May 9, 2016

Revised Department of Labor Overtime Proposal ‘Unacceptable’

The U.S. Department of Labor is considering a plan to reduce the cap on its forthcoming overtime salary threshold rate hike from $50,440 to $47,000. This minimal reduction would still amount to a 99% increase from the current overtime salary limit of $23,660.

National Association of Home Builders Chairman Ed Brady issued an official statement responding to the plan, declaring that “this proposal is a token effort at best” and is “unacceptable to America’s small businesses.”

“The unintended consequences of this aggressive regulatory overreach would hurt job and economic growth, as well as many of the workers the plan is trying to help,” Brady added. “There is no reasonable approach or road map on how this would be phased in without resulting in severe economic repercussions. If the $47,000 overtime threshold were to become law, it would hurt millions of small business owners, including home building firms, by forcing them to scale back on pay and benefits, as well as cutting workers’ hours to avoid overtime requirements. Indeed, it would be particularly harmful to the housing community, as the vast majority of home building firms have fewer than 10 employees.

“The Department of Labor must scrap this unworkable proposal and go back to the drawing board. We stand ready to work with Department of Labor to craft a practical plan that would gradually ramp up the current overtime threshold so that it does not result in real hardship for small businesses. The rule should also take into account regional variations in wages and cost of living when determining its formula. Such a measured response would help small business, workers and the economy.”

National Association of Home Builders Chairman Ed Brady issued an official statement responding to the plan, declaring that “this proposal is a token effort at best” and is “unacceptable to America’s small businesses.”

“The unintended consequences of this aggressive regulatory overreach would hurt job and economic growth, as well as many of the workers the plan is trying to help,” Brady added. “There is no reasonable approach or road map on how this would be phased in without resulting in severe economic repercussions. If the $47,000 overtime threshold were to become law, it would hurt millions of small business owners, including home building firms, by forcing them to scale back on pay and benefits, as well as cutting workers’ hours to avoid overtime requirements. Indeed, it would be particularly harmful to the housing community, as the vast majority of home building firms have fewer than 10 employees.

“The Department of Labor must scrap this unworkable proposal and go back to the drawing board. We stand ready to work with Department of Labor to craft a practical plan that would gradually ramp up the current overtime threshold so that it does not result in real hardship for small businesses. The rule should also take into account regional variations in wages and cost of living when determining its formula. Such a measured response would help small business, workers and the economy.”

Labels:

Codes & Regulations,

Overtime,

Wage and Hour Laws

Survey Says: Larger Remodeling Projects Trending Up

Whole house remodels and additions are regaining market share, according to a new survey of remodelers released May 2nd to kick off May’s National Home Remodeling Month. Released by National Association of Home Builders Remodelers, the survey revealed the most common projects in 2016 compared to results of previous surveys.

“While bathroom and kitchen remodels remain the most common renovations, basements, whole-house remodels and both large- and small-scale additions are returning to levels not seen since prior to the downturn,” said 2016 National Association of Home Builders Remodelers Chair Tim Shigley, CAPS, CGP, GMB, GMR.

In the survey, remodelers reported that the following projects were more common than in 2013:

Whole house remodels, which increased by 10%

Bathrooms topped the list of most common remodeling projects for the fifth time since 2010. Eighty-one percent of remodelers reported that bathrooms were a common remodeling job for their companies, while 79% reported the same for kitchen remodels. Window and door replacements decreased to 36% from 45% in 2014.

“While bathroom and kitchen remodels remain the most common renovations, basements, whole-house remodels and both large- and small-scale additions are returning to levels not seen since prior to the downturn,” said 2016 National Association of Home Builders Remodelers Chair Tim Shigley, CAPS, CGP, GMB, GMR.

In the survey, remodelers reported that the following projects were more common than in 2013:

Whole house remodels, which increased by 10%

- Room additions, 12%

- Finished basements, 8%

- Bathroom additions, 7%

Bathrooms topped the list of most common remodeling projects for the fifth time since 2010. Eighty-one percent of remodelers reported that bathrooms were a common remodeling job for their companies, while 79% reported the same for kitchen remodels. Window and door replacements decreased to 36% from 45% in 2014.

Subscribe to:

Comments (Atom)