Existing Home Sales

Existing home sales, as reported by the National Association of Realtors (NAR), surged 14.7% in December, including an increase in the first-time buyer share to 32%, the highest share since August. December sales snapped back from a November decline partially attributable to delays in closings from the rollout of the Know Before You Owe mortgage disclosure rule by the Consumer Financial Protection Bureau (CFPB). The new rule was designed to help consumers understand their loan options and avoid closing cost surprises. Total existing home sales in December increased to a seasonally adjusted rate of 5.46 million units combined for single-family homes, townhomes, condominiums and co-ops, up from 4.76 million units in November. December existing sales were up 7.7% from the same period a year ago.Existing sales increased in all regions, ranging from 8.7% in the Northeast to 23.2% in the West. Year-over-year, all regions increased, ranging from 4.6% in the South to 11.9% in the Northeast.

Total housing inventory decreased by 12.3% in December, and is 3.8% lower than its level a year ago. At the current sales rate, the December unsold inventory represents a 3.9-month supply, down from a 5.1-month supply in November. Some 32% of homes sold in December were on the market for less than a month.

Distressed sales are defined as foreclosures and short sales sold at deep discounts. The distressed sales share decreased to 8% in December from 9% in November. The December all-cash sales share decreased to 24% from 27% in November and 26% in December 2014. Individual investors purchased a 15% share in December, down from 16% in November and 17% a year ago.

The December median sales price of $224,100 was 7.6% above last December, and represents the 46th consecutive month of year-over-year increase. The median condominium/co-op price of $209,900 in December was up 4.9% from last December.

Although the Pending Home Sales Index fell slightly in November, the sharp volatility in November and December sales was a function of implementing a new regulation. Builder sentiment remains strong, and the tight inventory of existing homes bodes well for new single-family sales in 2016.

“This is a really good indicator that the real estate market

is returning to normal levels. When existing home sales rise it stimulates

sales of new homes, and it stimulates remodeling activity," said Home Builders Association of Greenville President Joe Hoover, APB, of Hoover Custom Homes.

New Home Sales

Sales of newly built, single-family homes rose 14.5% to 501,000 units in 2015: the highest level since 2007, according to newly released data from the Department of Housing and Urban Development and the U.S. Census Bureau. Meanwhile, sales in December increased 10.8% to a seasonally adjusted annual rate of 544,000 from an upwardly revised November reading.“The December sales report is a great end to a very strong year,” said National Association of Home Builders Chairman Ed Brady. “As we move forward in 2016, we should see the housing market continue to make lasting gains.”

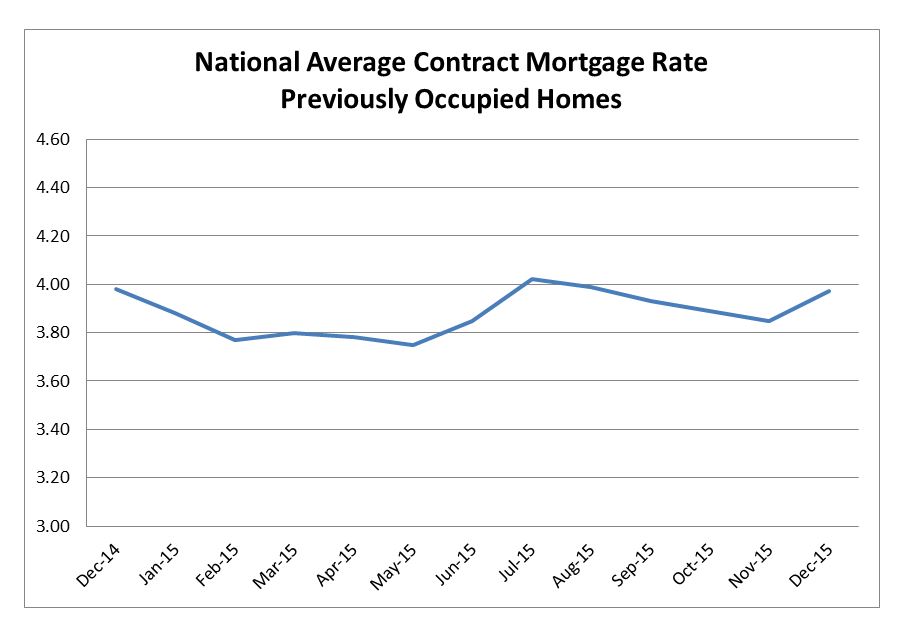

“Relatively low interest rates and an improving economy are motivating buyers to make a new-home purchase,” said National Association of Home Builders Chief Economist David Crowe. “Builders are upping their inventory in response to heightened consumer interest. Housing inventory is now at its highest level since October 2009.”

Sales increased in all four regions in December. The Midwest, West, Northeast and South all posted respective gains of 31.6%, 21%, 20.85% and 0.4%.

The inventory of new homes for sale was 237,000 units in December, a 5.2-month supply at the current sales pace.

Combining the reports of increasing sales of existing and new homes points to an overall increase in the housing market. Considering recent history, those in the building industry should always be cautious, but these reports point to a strengthening economy.

i