Builders--take a look at this short video comparing the water absorption rates of different spray foams.

Friday, April 8, 2016

Tuesday, April 5, 2016

Federal Housing Finance Agency House Price Index Up 0.5% in January

From the Federal Housing Finance Agency:

U.S. house prices rose in January, up 0.5 percent on a seasonally adjusted basis from the previous month, according to the Federal Housing Finance Agency monthly House Price Index. The previously reported 0.4 percent increase in December was revised upward to reflect a 0.5 percent increase.

The Federal Housing Finance Agency monthly House Price Index is calculated using home sales price information from mortgages sold to, or guaranteed by, Fannie Mae and Freddie Mac. From January 2015 to January 2016, house prices were up 6.0 percent.

For the nine census divisions, seasonally adjusted monthly price changes from December 2015 to January 2016 ranged from -1.0 percent in the Middle Atlantic division to +1.7 percent in the South Atlantic division. The 12-month changes were all positive, ranging from +1.7 percent in the Middle Atlantic division to +8.9 percent in the South Atlantic division.

Monthly index values and appreciation rate estimates for recent periods are provided in the table and graphs on the following pages. Complete historical data are available on the Downloadable House Price Index Data page.

For detailed information on the monthly House Price Index, see House Price Index Frequently Asked Questions. The next House Price Index report will be released April 21, 2016 and will include monthly data through February 2016.

Federal Housing Finance Agency has published House Price Index release dates for 2016, which can be found on the House Price Index Release dates page.

U.S. house prices rose in January, up 0.5 percent on a seasonally adjusted basis from the previous month, according to the Federal Housing Finance Agency monthly House Price Index. The previously reported 0.4 percent increase in December was revised upward to reflect a 0.5 percent increase.

The Federal Housing Finance Agency monthly House Price Index is calculated using home sales price information from mortgages sold to, or guaranteed by, Fannie Mae and Freddie Mac. From January 2015 to January 2016, house prices were up 6.0 percent.

For the nine census divisions, seasonally adjusted monthly price changes from December 2015 to January 2016 ranged from -1.0 percent in the Middle Atlantic division to +1.7 percent in the South Atlantic division. The 12-month changes were all positive, ranging from +1.7 percent in the Middle Atlantic division to +8.9 percent in the South Atlantic division.

Monthly index values and appreciation rate estimates for recent periods are provided in the table and graphs on the following pages. Complete historical data are available on the Downloadable House Price Index Data page.

For detailed information on the monthly House Price Index, see House Price Index Frequently Asked Questions. The next House Price Index report will be released April 21, 2016 and will include monthly data through February 2016.

Federal Housing Finance Agency has published House Price Index release dates for 2016, which can be found on the House Price Index Release dates page.

Home Builders, Others File Suit Over Silica Rule

Eight construction industry organizations including the Texas Association of Builders filed a petition for review today of the final crystalline silica rule by the Occupational Safety and Health Administration with the U.S. Court of Appeals for the Fifth Circuit.

The affiliated national organizations for these groups—National Association of Home Builders, the American Road and Transportation Builders Association, American Subcontractors Association, Associated Builders and Contractors, The Associated General Contractors of America, Mason Contractors Association of America and Mechanical Contractors Association of America—will join the petition.

The construction industry raised numerous concerns regarding Occupational Safety and Health Administration’s proposal, but the agency failed to address many of these issues when promulgating the final rule. In particular, the industry presented substantial evidence that Occupational Safety and Health Administration’s proposed permissible exposure limit was technologically and economically infeasible.

The groups are concerned that the agency failed to take into account this evidence and moved forward with the same infeasible permissible exposure limit in the final rule. This and other final rule provisions display a fundamental misunderstanding of the real world of construction. The construction industry petitioners continue to be active participants in the rulemaking process and are dedicated to promoting healthy and safe construction jobsites.

The affiliated national organizations for these groups—National Association of Home Builders, the American Road and Transportation Builders Association, American Subcontractors Association, Associated Builders and Contractors, The Associated General Contractors of America, Mason Contractors Association of America and Mechanical Contractors Association of America—will join the petition.

The construction industry raised numerous concerns regarding Occupational Safety and Health Administration’s proposal, but the agency failed to address many of these issues when promulgating the final rule. In particular, the industry presented substantial evidence that Occupational Safety and Health Administration’s proposed permissible exposure limit was technologically and economically infeasible.

The groups are concerned that the agency failed to take into account this evidence and moved forward with the same infeasible permissible exposure limit in the final rule. This and other final rule provisions display a fundamental misunderstanding of the real world of construction. The construction industry petitioners continue to be active participants in the rulemaking process and are dedicated to promoting healthy and safe construction jobsites.

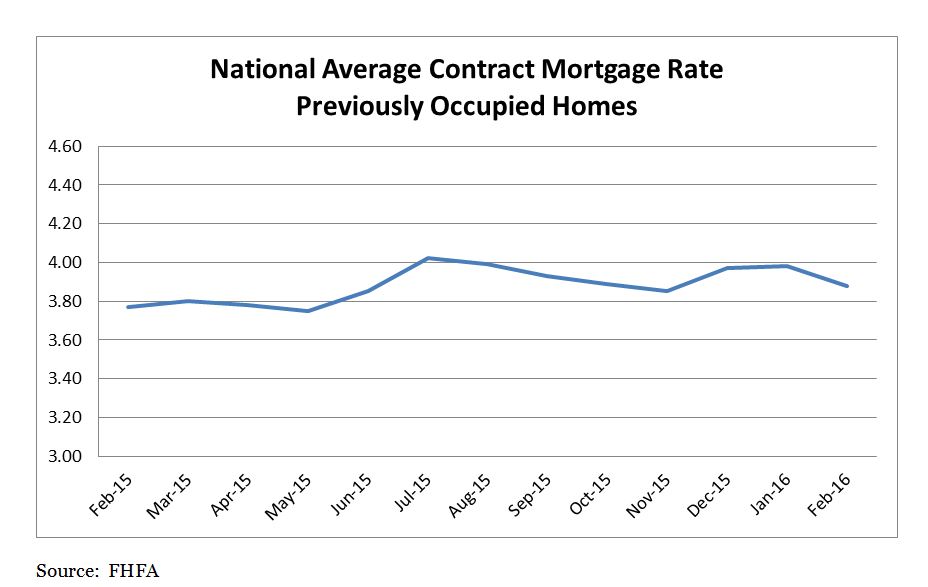

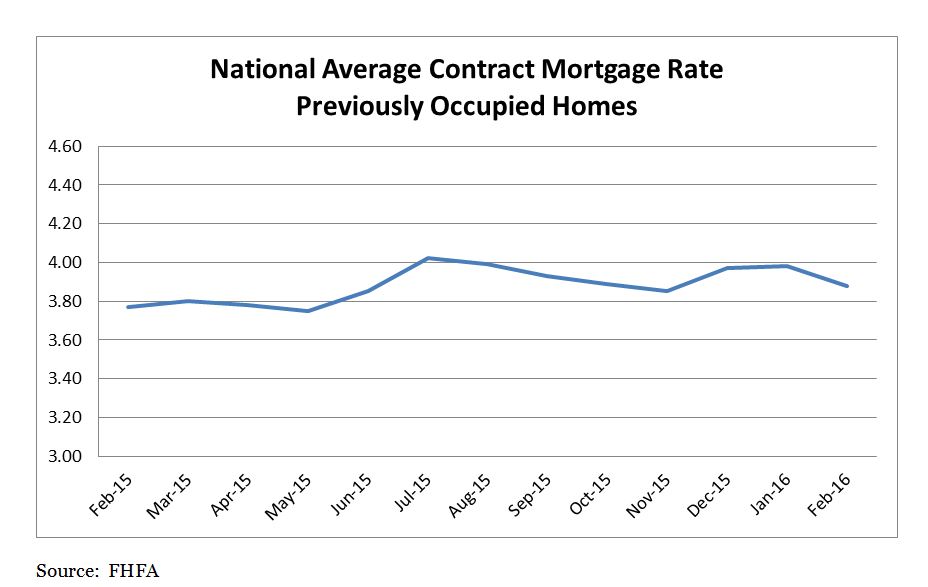

FHFA Index Shows Mortgage Interest Rates Decreased in February

From the Federal Housing Finance Agency:

Technical note: The indices are based on a small monthly survey of mortgage lenders, which may not be representative. The sample is not a statistical sample but is rather a convenience sample. Survey respondents were asked to report terms and conditions of all conventional, single-family, fully amortized purchase-money loans closed during the last five working days of the month. Unless otherwise specified, the indices include 15-year mortgages and adjustable-rate mortgages. The indices do not include mortgages guaranteed or insured by either the Federal Housing Administration or the U.S. Department of Veterans Affairs. The indices also excluded refinancing loans and balloon loans. February 2016 values are based on 3,526 reported loans from 20 lenders, which include savings associations, mortgage companies, commercial banks, and mutual savings banks.

Nationally, interest rates on conventional purchase-money mortgages decreased from January to February, according to several indices of new mortgage contracts.

The National Average Contract Mortgage Rate for the Purchase of Previously Occupied Homes by Combined Lenders Index was 3.88 percent for loans closed in late February, down 10 basis points from 3.98 percent in January.

The average interest rate on all mortgage loans was 3.89 percent, down 8 basis points from 3.97 in January.

The average interest rate on conventional, 30-year, fixed-rate mortgages of $417,000 or less was 4.11 percent, down 12 basis points from 4.23 in January.

The effective interest rate on all mortgage loans was 4.03 percent in February, down 7 basis points from 4.10 in January. The effective interest rate accounts for the addition of initial fees and charges over the life of the mortgage.

The average loan amount for all loans was $316,700 in February, up $6,300 from $310,400 in January.

The Federal Housing Finance Agency will release March index values Thursday, April 28, 2016. To find the complete contract rate series, go to http://www.fhfa.gov/DataTools/Downloads/Pages/Monthly-Interest-Rate-Data.aspx.

The National Average Contract Mortgage Rate for the Purchase of Previously Occupied Homes by Combined Lenders Index was 3.88 percent for loans closed in late February, down 10 basis points from 3.98 percent in January.

The average interest rate on all mortgage loans was 3.89 percent, down 8 basis points from 3.97 in January.

The average interest rate on conventional, 30-year, fixed-rate mortgages of $417,000 or less was 4.11 percent, down 12 basis points from 4.23 in January.

The effective interest rate on all mortgage loans was 4.03 percent in February, down 7 basis points from 4.10 in January. The effective interest rate accounts for the addition of initial fees and charges over the life of the mortgage.

The average loan amount for all loans was $316,700 in February, up $6,300 from $310,400 in January.

The Federal Housing Finance Agency will release March index values Thursday, April 28, 2016. To find the complete contract rate series, go to http://www.fhfa.gov/DataTools/Downloads/Pages/Monthly-Interest-Rate-Data.aspx.

Technical note: The indices are based on a small monthly survey of mortgage lenders, which may not be representative. The sample is not a statistical sample but is rather a convenience sample. Survey respondents were asked to report terms and conditions of all conventional, single-family, fully amortized purchase-money loans closed during the last five working days of the month. Unless otherwise specified, the indices include 15-year mortgages and adjustable-rate mortgages. The indices do not include mortgages guaranteed or insured by either the Federal Housing Administration or the U.S. Department of Veterans Affairs. The indices also excluded refinancing loans and balloon loans. February 2016 values are based on 3,526 reported loans from 20 lenders, which include savings associations, mortgage companies, commercial banks, and mutual savings banks.

Monday, April 4, 2016

Changes to Flood Insurance Rates Effective April 1

Several changes to the National Flood Insurance Program take effect on April 1, impacting a wide range of builders, developers, businesses, home owners and insurance agents operating in areas covered by the National Flood Insurance Program.

Federal Emergency Management Agency has indicated that the maximum individual rate increase for any individual policy is 18%, with a few exceptions. The guidance also states that average premiums – once certain fees are accounted for – will increase 9% for policies written or renewed on or after April 1. For most risk classes, the average annual premium rate increases are limited to 15%.

Many of the changes are a result of continued implementation of the Homeowner Flood Insurance Affordability Act of 2014 and the Biggert-Waters Flood Insurance Reform Act of 2012 (BW-12). Congress passed BW-12 and subsequently Homeowner Flood Insurance Affordability Act to reauthorize and reform the program.

In its summary, Federal Emergency Management Agency notes that changes will also affect mapping, mitigation efforts and program outreach. Each property will see distinct impacts because characteristics such as flood zone, year built (which affects whether it is depicted on the Flood Insurance Rate Map) and property type still play a role in individual premiums.

Other changes include new rating methodology for properties newly mapped into a Special Flood Hazard Area and the elimination of subsidies for certain pre-FIRM policies that lapse and are reinstated past 90 days. In instances where a policyholder wants to return to the National Flood Insurance Program program after the lapse, he or she must obtain an elevation certificate and use the full-risk rate.

Furthermore, Homeowner Flood Insurance Affordability Act Section 28 requires Federal Emergency Management Agency to clearly communicate full flood risk determinations to individual property owners, regardless of whether their premium rates are full-risk rates. To achieve this, Federal Emergency Management Agency will require National Flood Insurance Program insurers to report current flood zone and rate map information for all new business polices effective on or after April 1 and for all renewals effective on or after Oct. 1.

The $25 surcharge for single-family primary residences and the $250 surcharge for all other policies, which went into effect April 1, 2015, remains unchanged.

This round of implementation activity occurs at the same time as regulators look ahead to the next round of program reauthorizations. Congress must pass National Flood Insurance Program reauthorization by Sept. 30, 2017.

In January, the National Association of Home Builders took part in an introductory roundtable and a hearing to discuss National Flood Insurance Program re-authorization. Congress plans to release draft legislation by the end of 2016.

Federal Emergency Management Agency has indicated that the maximum individual rate increase for any individual policy is 18%, with a few exceptions. The guidance also states that average premiums – once certain fees are accounted for – will increase 9% for policies written or renewed on or after April 1. For most risk classes, the average annual premium rate increases are limited to 15%.

Many of the changes are a result of continued implementation of the Homeowner Flood Insurance Affordability Act of 2014 and the Biggert-Waters Flood Insurance Reform Act of 2012 (BW-12). Congress passed BW-12 and subsequently Homeowner Flood Insurance Affordability Act to reauthorize and reform the program.

In its summary, Federal Emergency Management Agency notes that changes will also affect mapping, mitigation efforts and program outreach. Each property will see distinct impacts because characteristics such as flood zone, year built (which affects whether it is depicted on the Flood Insurance Rate Map) and property type still play a role in individual premiums.

Other changes include new rating methodology for properties newly mapped into a Special Flood Hazard Area and the elimination of subsidies for certain pre-FIRM policies that lapse and are reinstated past 90 days. In instances where a policyholder wants to return to the National Flood Insurance Program program after the lapse, he or she must obtain an elevation certificate and use the full-risk rate.

Furthermore, Homeowner Flood Insurance Affordability Act Section 28 requires Federal Emergency Management Agency to clearly communicate full flood risk determinations to individual property owners, regardless of whether their premium rates are full-risk rates. To achieve this, Federal Emergency Management Agency will require National Flood Insurance Program insurers to report current flood zone and rate map information for all new business polices effective on or after April 1 and for all renewals effective on or after Oct. 1.

The $25 surcharge for single-family primary residences and the $250 surcharge for all other policies, which went into effect April 1, 2015, remains unchanged.

This round of implementation activity occurs at the same time as regulators look ahead to the next round of program reauthorizations. Congress must pass National Flood Insurance Program reauthorization by Sept. 30, 2017.

In January, the National Association of Home Builders took part in an introductory roundtable and a hearing to discuss National Flood Insurance Program re-authorization. Congress plans to release draft legislation by the end of 2016.

National Association of Home Builders, National Federation of Independent Business File Law Suit Against New Union Persuader Rule

The National Association of Home Builders and the National Federation of Independent Business filed a lawsuit yesterday against the U.S. Department of Labor asserting that the agency’s new union persuader rule violates business owners’ First Amendment rights, making it nearly impossible to consult with legal counsel when facing union organizing.

The rule is fundamentally unfair because it requires employers to report to the Department of Labor whether and when they consult with a lawyer to discuss union organizing. The unions, on the other hand, aren’t encumbered by any such requirement.

“The Department of Labors’s final persuader rule is another example of regulatory overreach that will impose far-reaching reporting requirements on employers and their consultants and result in significant monetary and legal implications for home building firms,” said National Association of Home Builders Chairman Ed Brady in a joint press release with National Federation of Independent Business. “This lawsuit is necessary to maintain long standing policy on what union-related communications between employers and attorneys remain confidential.”

The Texas Association of Builders, Texas Association of Business and the Lubbock Chamber of Commerce joined the National Association of Home Builders and National Federation of Independent Business in filing a lawsuit against the Department of Labor in the United States District Court, Northern District of Texas, Lubbock Division.

The business groups maintain that the rule violates the First Amendment’s guarantee of freedom of speech and right of association. Also, according to the plaintiffs, the rule violates the Due Process Clause of the Fourteenth Amendment and the Regulatory Flexibility Act.

Previously, business owners were only required to report when outside counsel directly communicated with employees. Under the new rule, business owners will have to report any communication with legal counsel even if the matter ends there.

The rule is fundamentally unfair because it requires employers to report to the Department of Labor whether and when they consult with a lawyer to discuss union organizing. The unions, on the other hand, aren’t encumbered by any such requirement.

“The Department of Labors’s final persuader rule is another example of regulatory overreach that will impose far-reaching reporting requirements on employers and their consultants and result in significant monetary and legal implications for home building firms,” said National Association of Home Builders Chairman Ed Brady in a joint press release with National Federation of Independent Business. “This lawsuit is necessary to maintain long standing policy on what union-related communications between employers and attorneys remain confidential.”

The Texas Association of Builders, Texas Association of Business and the Lubbock Chamber of Commerce joined the National Association of Home Builders and National Federation of Independent Business in filing a lawsuit against the Department of Labor in the United States District Court, Northern District of Texas, Lubbock Division.

The business groups maintain that the rule violates the First Amendment’s guarantee of freedom of speech and right of association. Also, according to the plaintiffs, the rule violates the Due Process Clause of the Fourteenth Amendment and the Regulatory Flexibility Act.

Previously, business owners were only required to report when outside counsel directly communicated with employees. Under the new rule, business owners will have to report any communication with legal counsel even if the matter ends there.

Subscribe to:

Comments (Atom)